Investing in a home is a significant life decision, but when someone is relocating from their home country permanently with their family, selling assets and transferring funds to another country becomes a crucial step. This includes selling immovable property, such as real estate. For Non-Resident Indians (NRIs), selling property in India and repatriating the entire sale amount abroad may encounter a hurdle in the form of income tax regulations.

According to the Income Tax Act of 1961, if the seller is a resident of India, the buyer must deduct tax at a rate of 1%. However, the scenario changes for NRIs. In the case of NRIs selling property in India, the buyer is required to deduct tax at a higher rate of 20%, along with surcharge and cess. This deduction, amounting to 23.92% (20% + 15% surcharge + 4% cess), significantly reduces the repatriated amount, even if the NRI did not earn any income from the property sale.

Let’s consider an example: if an NRI purchased a property for Rs 2 crore in June 2013 and now wishes to sell it for Rs 1.9 crore upon leaving India permanently, the buyer would deduct a TDS of 23.92%. This means the NRI can only repatriate three-fourths of the sale amount, a substantial reduction.

Even in cases where there is no gain, the income tax department insists on TDS deduction, emphasizing that anyone not residing in India should not repatriate income earned in the country without paying the necessary income tax.

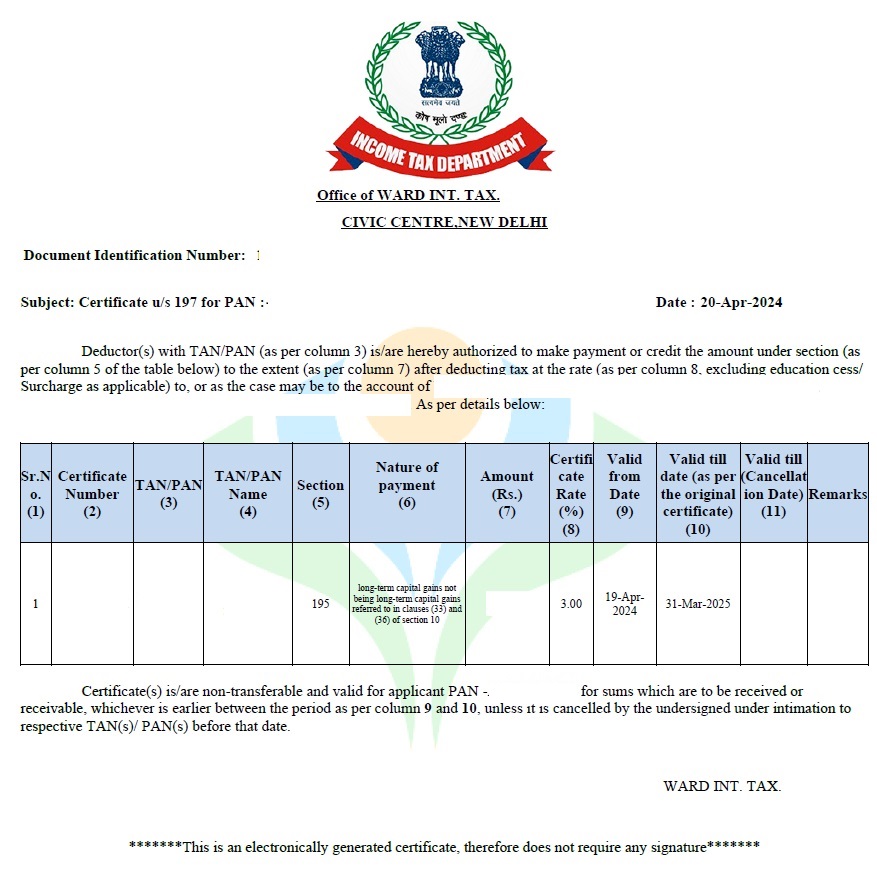

However, there is a catch and a relief for NRIs, irrespective of their country (USA, UK, Europe, Canada, Australia, New Zealand, etc.). NRIs have the option to apply for a lower TDS certificate for NRI from the income tax authorities. This involves requesting a TDS rate calculated based on the capital gain from the sale of immovable property. It is advisable to apply for this certificate before the sale transaction occurs.

The application process for a lower TDS certificate for NRI involves submitting a comprehensive set of documents accurately on the designated portal. Accuracy is crucial, as any mistakes may prompt the tax department to request corrective actions and additional requirements. To streamline this process, NRIs are encouraged to seek the assistance of a reliable chartered accountant firm. Chartered accountants not only compile the necessary documents but also expedite the application for a lower TDS certificate for NRI, ensuring a smoother process in a few days.

Additionally, it’s essential to understand the surcharge rates applicable to the sale of immovable property. Surcharge is an extra charge levied on individuals with income above specified limits. The rates are as follows:

- 10%: Taxable income above ₹50 lakh – up to ₹1 crore

- 15%: Taxable income above ₹1 crore – up to ₹2 crore

- 25%: Taxable income above ₹2 crore – up to ₹5 crore

- 37%: Taxable income above ₹5 crore

In summary, for NRIs looking to sell property in India and repatriate funds, complying the TDS regulations is crucial. Applying for a lower TDS certificate for NRI can significantly enhance the amount that can be repatriated, providing a valuable opportunity for a smoother financial transition when leaving the country permanently.

A Small Story of NRI Selling of Immovable Property in India

Once there was a family moving to another country, and they needed to sell their home in India. They found out that selling a house meant dealing with complicated tax rules, especially since they were living abroad.

Even though they weren’t making any money from selling the house, they learned that the tax authorities would take a big chunk of the sale amount. But they discovered something called a lower TDS certificate, which could help them pay less tax.

With the help of chartered accountant, they applied for this lower tax certificate, but it wasn’t easy. They had to deal with lots of paperwork and wait anxiously for weeks, however with the help of Chartered accountant firm in India the process got easy. Finally, they got the good news—the certificate was approved!

With this certificate, they were able to sell their home and keep more of the money they earned. It was a tough journey, but they learned that facing challenges head-on could lead to great rewards.

As they moved to their new home, they carried with them not just memories but also the lesson that perseverance pays off, especially when dealing with complicated rules and regulations.

Here is the Format of Lower TDS Certificate for NRI