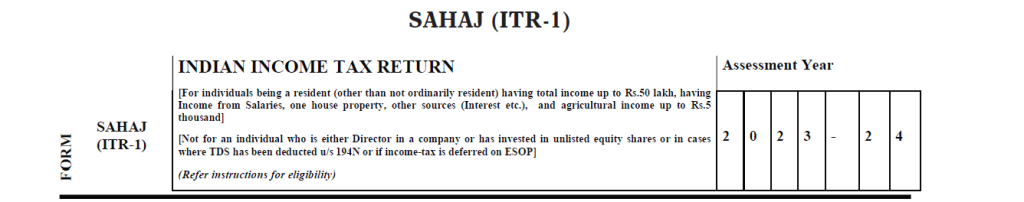

The ITR filing session for the financial year 2022-23 (Assessment Year 2023-24) has officially begun. Taxpayers across the country are gearing up to file their income tax returns before the deadline. To make the process smoother for you, we are here to discuss the details of the ITR 1 form. ITR-1, also known as Sahaj, is a form that is used to file income tax returns in India.

Who can File ITR using Form ITR 1

This form is applicable for individuals who are residents of India (other than not ordinarily residents) and have a total income of up to Rs. 50 lakh. The form can be used by individuals who have income from salaries, one house property, other sources (such as interest), and agricultural income up to Rs. 5,000.

Form ITR 1 Not Applicable for:

ITR-1 form is not applicable for individuals

(i) who are directors in a company,

(ii) have invested in unlisted equity shares, or

(iii) have had TDS deducted under section 194N.

(iv) It is also not applicable for individuals who have deferred income tax on ESOP.

Parts of Form ITR 1

The form has to be filed for the assessment year 2023-24 and includes two parts: Part A and Part B.

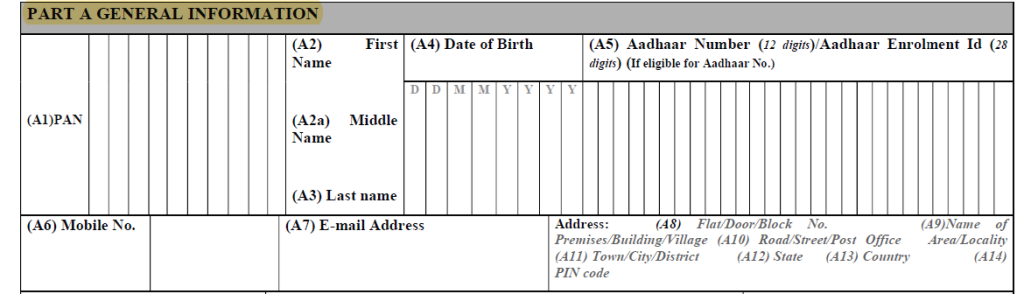

PART A GENERAL INFORMATION

Part A of the form contains general information about the individual such as name, date of birth, PAN, Aadhaar number, mobile number, email address, and address. It also contains information about the nature of employment, whether the individual is filing the return on or before the due date, if the return is revised or defective, and if the individual is opting for the new tax regime under section 115BAC.

Part A also includes a section for individuals who are filing the return of income under the seventh proviso to section 139(1) but are otherwise not required to furnish a return of income. This section requires the individual to provide information on whether they have incurred expenditure on foreign travel or electricity consumption and if they are required to file a return as per other conditions prescribed under clause (iv) of the seventh proviso to section 139(1).

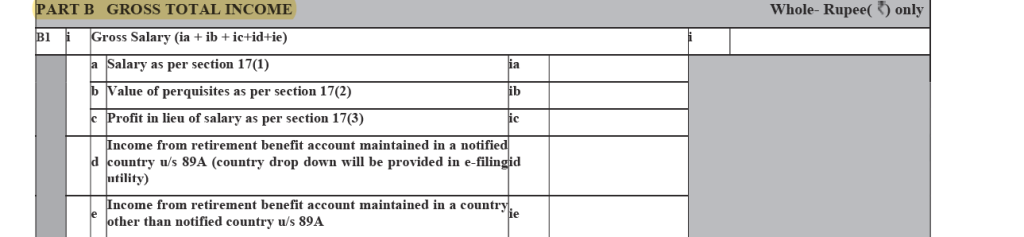

PART B GROSS TOTAL INCOME

Part B of the form requires the individual to provide details of their gross total income, deductions, and tax payable. The section includes information on income from salary, house property, other sources, and agricultural income.

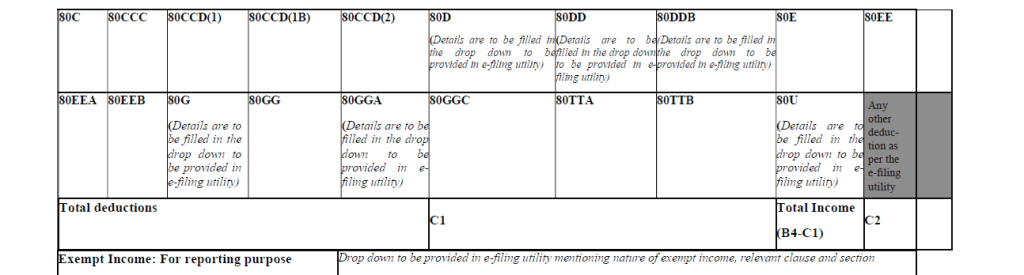

PART C – DEDUCTIONS AND TAXABLE TOTAL INCOME

It includes information on deductions such as section 80C, 80D, 80DD, 80E, 80EE 80G and 80U.

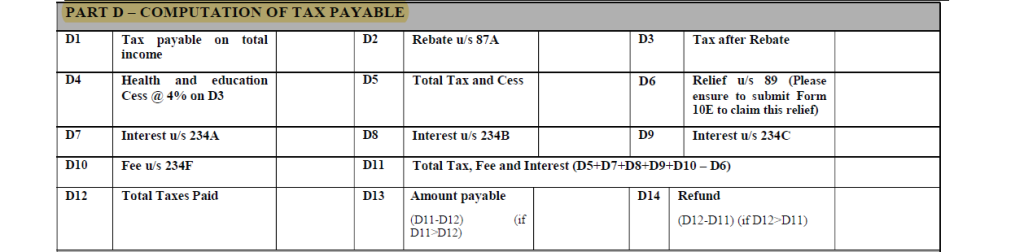

PART D – COMPUTATION OF TAX PAYABLE

Part D of ITR1 includes computation of tax payable such as Tax payable on total income, Rebate u/s 87A, Tax after Rebate, Health and education Cess @ 4%, Total Tax and Cess, Relief u/s 89, Interest u/s 234A, Interest u/s 234B, Interest u/s 234C, Fee u/s 234F, and Refund

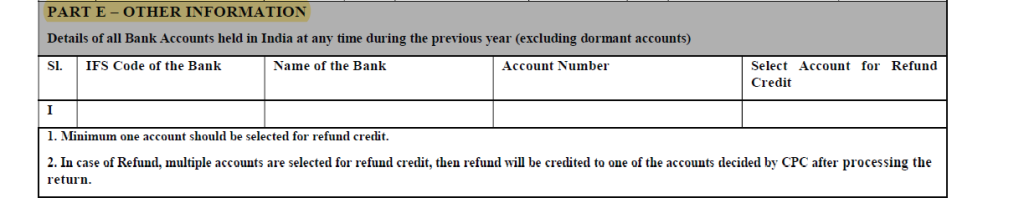

PART E – OTHER INFORMATION

Part E of the form requires disclosure of all active bank accounts held in India during the previous year. Dormant accounts need not be included in this section.

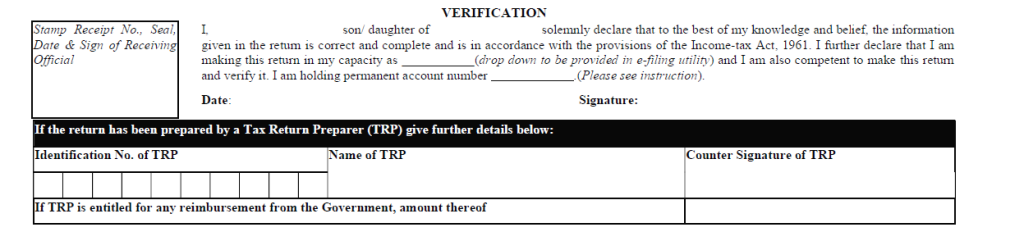

Once the form is filled out, the individual must verify it and submit it to the income tax department. It is important to ensure that all information provided is accurate and complete to avoid any penalties or legal action.

One important thing to keep in mind while filing ITR 1 is that the taxpayer should have all the necessary documents, such as Form 16 and Form 26AS, before starting the process. Form 16 is a certificate issued by the employer that shows the taxpayer’s salary and tax deducted at source. Form 26AS is a statement that shows the taxpayer’s tax credits, including TDS deducted by the employer and taxes paid by the taxpayer.

Another important point to note is that the deadline for filing ITR 1 for the financial year 2022-23 is 31st July 2023. Failure to file the return by the due date may result in a penalty or interest.