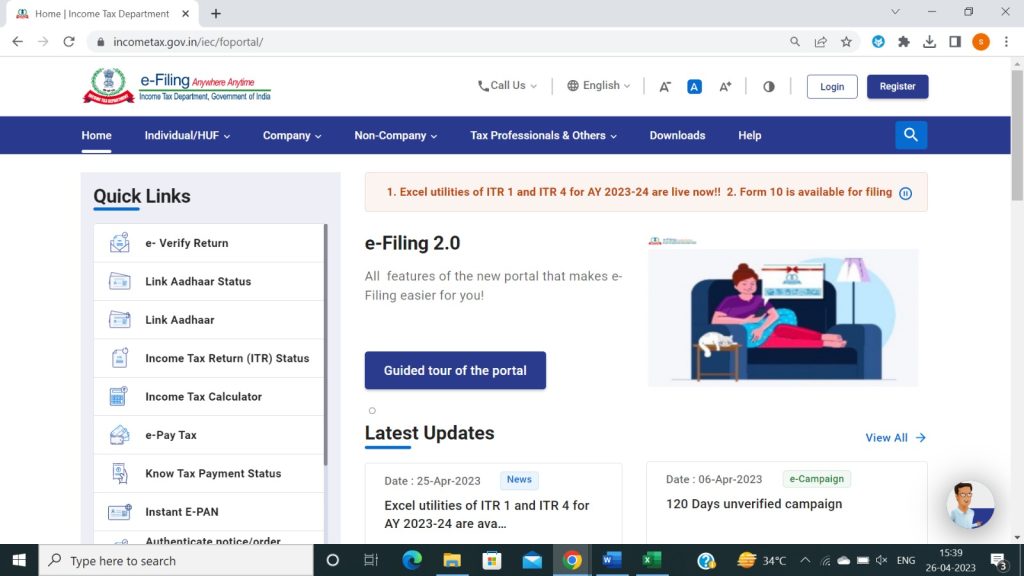

The Income Tax Department has released Excel utilities for ITR 1 and 4 for the assessment year 2023-24. Taxpayers can access these utilities by referring to the live ticker on the e-filing portal at http://incometax.gov.in.

We would like to inform taxpayers that the software and utilities for other ITRs and forms for the assessment year 2023-24 will also be enabled shortly by the Income Tax Department. We will make the necessary information available to taxpayers on the e-filing portal as soon as possible.

In the meantime, we encourage all taxpayers to gather their documents and be prepared for the tax filing process. It is important to have all the necessary documents ready in order to file an accurate tax return.

ITR filing last date for AY 2023 24

The due date for filing income tax return (ITR) varies depending on the type of taxpayer and the income earned during the financial year.

For individuals, Hindu Undivided Families (HUFs), and taxpayers whose accounts are not required to be audited, the due date for filing ITR is usually July 31st of the assessment year. For example, for the financial year 2022-23, the due date for filing ITR for individuals and HUFs would be July 31st, 2023.

For taxpayers who are required to get their accounts audited under any law, including the Income Tax Act, the due date for filing ITR is usually October 31st of the assessment year.

It is crucial for taxpayers to file their ITR on time to avoid penalties and interest on the outstanding tax liability. Filing ITR on time also helps in timely processing of tax refunds, if applicable.

In case a taxpayer is unable to file their ITR by the due date, they can file a belated return within a certain period. For individuals and HUFs, the belated return can be filed 3 months before the end of the relevant assessment year (i.e 31st December of the assessment year).

Therefore, taxpayers should ensure that they file their ITR on time and keep track of the due date to avoid any penalty or interest on their outstanding tax liability.