As an Non-Resident Indian (NRI), selling your property involves several crucial considerations. First and foremost, understanding the market value of your property at the time of sale is essential. Additionally, you need to understand the payment of income tax in India on the sale proceeds and the repatriation of funds out of India after tax payment.

For NRIs, finding a buyer and selling the property at the right price can be challenging. It’s a time-consuming process, often requiring NRIs to spend considerable time in India to finalize the sale deal. However, securing the right price and ensuring proper tax payments are crucial for a successful transaction.

We’ve learned of cases where NRIs are selling property, and buyers are deducting Tax Deducted at Source (TDS) at a rate of 20% along with surcharges and cess. NRIs might not anticipate such significant TDS deductions at the time of signing agreements with buyers. For instance, if an NRI agrees to sell a property for INR 2 crore and receives an advance of INR 5 lakhs from the buyer, the buyer will deduct TDS at a rate of 20% plus surcharge and cess on the entire sale amount, not just on the capital gain.

It’s crucial to note that TDS deductions occur on the total sale amount, which can lead to unexpected tax burdens for NRIs. Consider a scenario where an NRI bought a property for Rs 1.8 crore in 2013 and is now selling it for Rs 1.7 crore, resulting in no capital gain. Despite this, the buyer is required to deduct TDS at a rate of 23.92%, leaving the NRI with less cash on hand, affecting their ability to invest in a new property.

Although NRIs can claim TDS refunds by filing income tax returns, the process is lengthy and may take months to receive the refund, causing a blockage of funds. Moreover, Income Tax Return (ITR) forms aren’t immediately available on the income tax portal, adding to the delay.

To avoid fund blockages, NRIs can apply for a lower TDS certificate if they anticipate no significant gains or have incurred losses from the property sale. Under the Income Tax Act, NRIs have the option to request a lower TDS rate by applying to the international taxation officer. This involves submitting various documents and computations, which may necessitate hiring a chartered accountant or tax consultant to assist with the application process and liaise with tax authorities.

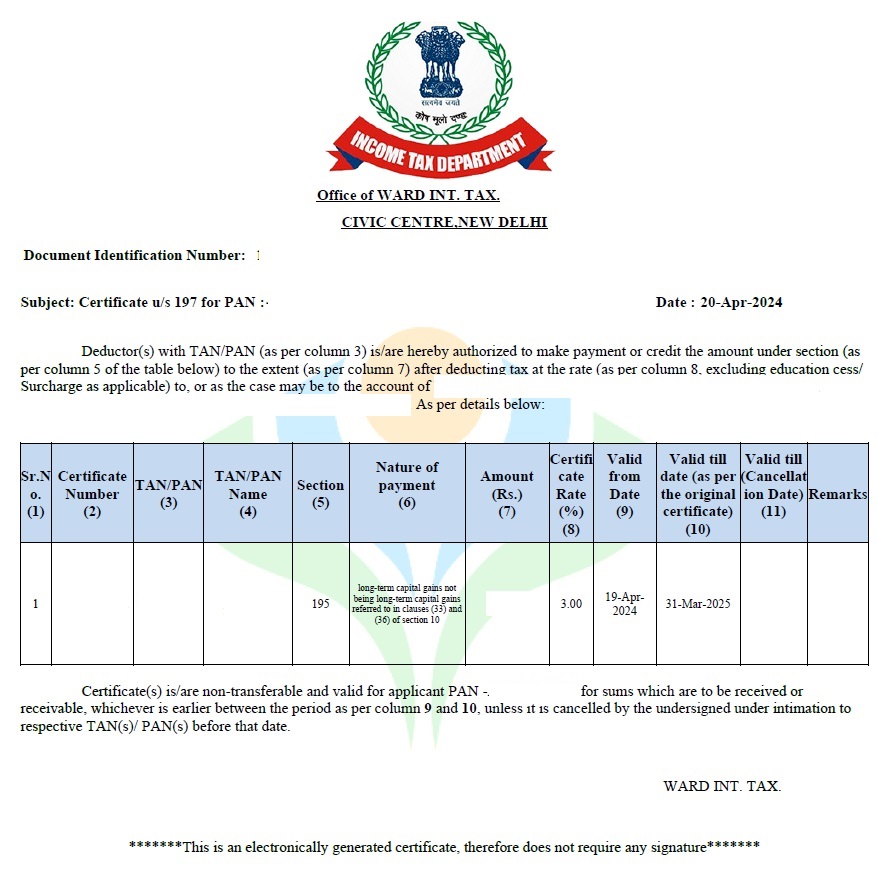

Here is the Format of Lower TDS Certificate For NRI issued by Income tax office:

In summary, selling property as an NRI involves understanding market values, income tax obligations, and managing TDS deductions. To mitigate fund blockages and ensure smoother transactions, NRIs can explore options like applying for lower TDS certificates with the assistance of tax professionals.

Below is a list of standard documents and information required from Non-Resident Indians (NRIs) when applying for a lower TDS rate. Please note that the specific documents may vary depending on the circumstances:

- Copy of the Agreement to Sale executed with the proposed buyer for the property to be sold.

- Copy of the title deed, such as sale deed/purchase deed/conveyance deed/registry of the property proposed to be sold.

- Copy of the current circle for the property proposed to be sold.

- Documentary evidence, such as bank account statements, showing the source of funds for acquiring the property proposed to be sold.

- Documentary evidence of the receipt of advance/earnest payment from the intending purchaser of the property proposed to be sold, including bank account statements of the applicant.

- Valuation report in case the property proposed to be sold was purchased before the financial year 2001.

- Proof of residential status, including a copy of the passport, foreign driver’s license, along with details of the stay in India during the last 5 years, including the current year, in the specified format: FY Date of Arrival in India Date of Departure Total Days of Stay in India

- Copy of the sale deed/gift deed if the property proposed to be sold was transferred to the applicant.

- Documentary evidence for renovation or construction, including map/plan sanction from local bodies, bills/invoices, and sources of funds for construction/renovation.

- Return of income for the last three years and details of outstanding demands, if any.

- Computation of estimated income for the current financial year.

- Proof of Indian address to ascertain the territorial jurisdiction of the case.

- Copy of the title deed, such as sale deed/purchase deed/conveyance deed/registry of the property, in respect of the new property purchased by the applicant for claiming a deduction under section 54 of the Income Tax Act, 1961.

- Documentary evidence, such as bank account statements, showing the source of funds for acquiring the new property from the capital gain arising from the sale of the said property.

- Proof of the Tax Deduction and Collection Account Number (TAN) of the buyer.