In a groundbreaking development, Chief Minister Sh. Manohar Lal has responded to the persistent appeals from Haryana’s vibrant traders and business community by launching the highly anticipated One Time Settlement-2023 (OTS) Scheme through the Excise and Taxation Department. The inauguration took place on December 31, 2023, marking a significant milestone in addressing long-standing tax issues predating the implementation of the Goods and Services Tax (GST). The scheme is scheduled to be in operation from January 1, 2024, to March 30, 2024, promising a transformative impact on the state’s economic landscape.

A Comprehensive Approach to Tax Resolution

Commencing from January 1, 2024, and concluding on March 30, 2024, businesses in Haryana are presented with a unique opportunity to settle pre-GST tax liabilities through the innovative OTS-2023 scheme. The scheme classifies taxes into four distinct categories, providing businesses with a tailored approach to resolving outstanding tax issues. Notably, the scheme offers exemptions from interest and penalties for cases related to seven tax acts that were in effect before the implementation of GST. Additionally, Chief Minister Sh. Manohar Lal seized the occasion to announce the establishment of a GST Training Institute in collaboration with HIPA, Gurugram, showcasing a commitment to enhancing tax compliance.

OTS Scheme Categories and Benefits

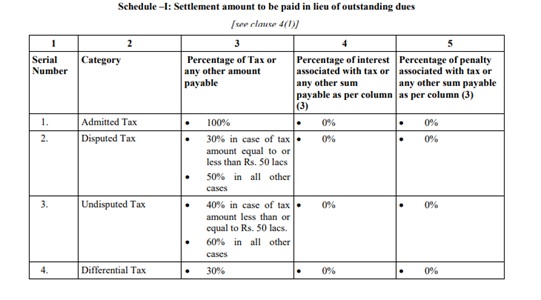

The OTS scheme categorizes tax liabilities into four distinct groups, each offering specific benefits to taxpayers:

- Admitted Tax: Under this category, taxpayers are required to pay 100% of the undisputed tax amount, with no additional penalties or interest.

- Disputed Tax: For disputed taxes amounting to less than Rs 50 lakh, taxpayers are obligated to pay 30% of the outstanding amount. For disputed taxes exceeding Rs 50 lakh, the payment obligation increases to 50%.

- Undisputed Tax: Taxes assessed by the department without any appeals fall into this category. Taxpayers must pay 40% of the tax amount if it is below Rs 50 lakh, and 60% if it exceeds Rs 50 lakh. This category also offers relief from penalties and interest.

- Differential Tax: This category addresses outstanding amounts due to differences in tax rates. The government has discounted the amount, requiring taxpayers to pay only 30% of the total.

The points mentioned earlier are depicted in the following charts:

Flexible Payment Options for Taxpayers

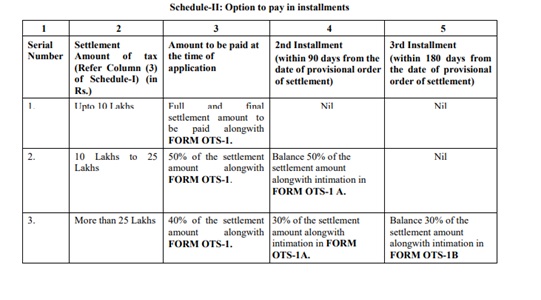

Recognizing the diverse financial capacities of taxpayers, the OTS scheme introduces flexible installment options for settling outstanding tax amounts:

- Below Rs 10 lakh: Taxpayers must pay the entire sum in one lump sum before March 30th.

- Rs 10 lakh to Rs 25 lakh: The amount can be paid in two installments, with 52% due at each installment.

- Above Rs 25 lakh: Taxpayers can opt for a three-installment plan – 40% in the first 90 days, 30% in the next 90 days, and the remaining 30% in the final 90 days.

Addressing Pre-GST Tax Issues

The One Time Settlement Scheme addresses outstanding tax issues from the Excise and Taxation Department until June 30, 2017. It specifically resolves concerns related to seven VAT-related acts, including the Haryana Value Added Tax Act, 2003, the Central Sales Tax Act, 1956, the Haryana Local Area Development Tax Act, 2000, the Haryana Tax on Entry of Goods in Local Area Act, 2008, the Haryana Luxury Tax Act, 2007, the Punjab Entertainment Fee Act, and the Haryana General Sales Tax Act, 1973.

Expanding Welfare Programs

Chief Minister Sh. Manohar Lal underscored the government’s commitment to public welfare and societal service, emphasizing that the One Lump Sum Settlement Scheme-2023 stands as a testament to this dedication. As part of the government’s continued efforts to provide relief, the Chief Minister announced the expansion of the Urban Ownership Scheme, a move set to benefit shopkeepers paying rent to local bodies for shops situated on land managed by various departments. This expansion aligns with the dual goals of offering relief to honest taxpayers while simultaneously boosting state revenue.

Haryana’s Robust Tax Infrastructure

Deputy Chief Minister Sh. Dushyant Singh Chautala lauded the Haryana Government’s implementation of the new scheme, emphasizing its dedication to the welfare of traders and industrialists. He highlighted the state’s achievement in being among the first five states in the country in terms of tax collection. The Deputy Chief Minister attributed this success to the cooperation of officers, employees, and taxpayers of the Excise and Taxation Department, asserting that Haryana now boasts the best tax infrastructure in the country.

Revenue Projection and Future Plans

The Deputy Chief Minister projected a significant revenue increase through the One Time Settlement-2023 scheme. Haryana, having already collected Rs 46 thousand crore in taxes, aims to achieve a collection of Rs 66 thousand crores by March 31, surpassing the Chief Minister’s target of Rs 58 thousand crores. The government also plans to establish branches of the GST Tribunal in Gurugram and Hisar, demonstrating a commitment to modernize their working style and address GST and tax collection issues efficiently.

The scheme shall be applicable to the following Acts, namely :-

(i) The Haryana Value Added Tax Act, 2003 (6 of 2003);

(ii) The Central Sales Tax Act, 1956 (Central Act 74 of 1956) ;

(iii) The Haryana Local Area Development Tax Act, 2000 (13 of 2000);

(iv) The Haryana Tax on Entry of Goods in to Local Areas Act, 2008 (8 of 2008) ;

(v ) The Haryana Tax on Luxuries Act, 2007 (23 of 2007) ;

(vi) The Punjab Entertainment Duty Act, 1955 (Punjab Act 16 of 1955) ;

(vii) The Haryana General Sales Tax Act, 1973 (20 of 1973)

Relevant Notifications:

- Notification No. 71/ST-1 ,

- Notification No. 72/ST-1

Conclusion: A New Dawn for Haryana’s Economy

In conclusion, the One Time Settlement-2023 scheme is poised to usher in a new era for Haryana’s economic landscape. By providing comprehensive tax relief and introducing flexible settlement options, the government aims to alleviate the burden on businesses and encourage compliance. This initiative reflects a forward-looking approach to addressing long-standing issues and fostering a conducive environment for economic growth. As Haryana embarks on this transformative journey, the One Time Settlement-2023 scheme stands as a beacon of hope, signaling a brighter future for businesses and traders in the state.