Understanding NRI (Non-Resident Indian) laws and how to comply with them when dealing with property transactions in India can be challenging, especially when you’re living outside the country. Even though resources like Google are easily accessible, finding accurate information can still be tricky due to search algorithms. As an NRI, one common concern revolves around selling property and understanding the associated laws and procedures.

Who is NRI and Where to Report NRI Status?

Firstly, let’s clarify what an NRI is. An NRI is someone who has been residing outside India for more than 182 days. When NRIs earn income in India and are liable to file income tax returns, they must declare their residential status. They can select their residential status as a non-resident while filing their tax returns and report their income accordingly.

Which laws apply to NRIs?

To handle the complexities of income tax and determine residential status, NRIs typically follow guidelines outlined by the Income Tax department, RBI, and the Foreign Exchange Management Act (FEMA). However, despite the availability of information online, many NRIs struggle to understand practical aspects like income tax rates applicable to property sales in India, way to calculate gain or loss on income tax or right way apply lower TDS certificate and getting in shorter period.

How Google Helps?

While articles on Google may provide information on tax rates, they often overlook the practical difficulties faced by NRIs during property transactions. Questions like how income tax is calculated on property sales, how gains arise, how indexations on property are done, whether there’s a way to apply for a lower TDS (Tax Deducted at Source) certificate, and if so, how to expedite the process when NRIs are only in India for a short period before leaving for other countries like the USA, Canada, or Australia, remain unanswered.

How Chartered Accountant helps?

As experienced chartered accountants familiar with NRI transactions, we can help address these concerns and facilitate fund repatriation out of India by assisting with Form 15 CA and Form 15CB filings. They should NRIs to hire tax consultants in India before any transaction to fully understand the implications.

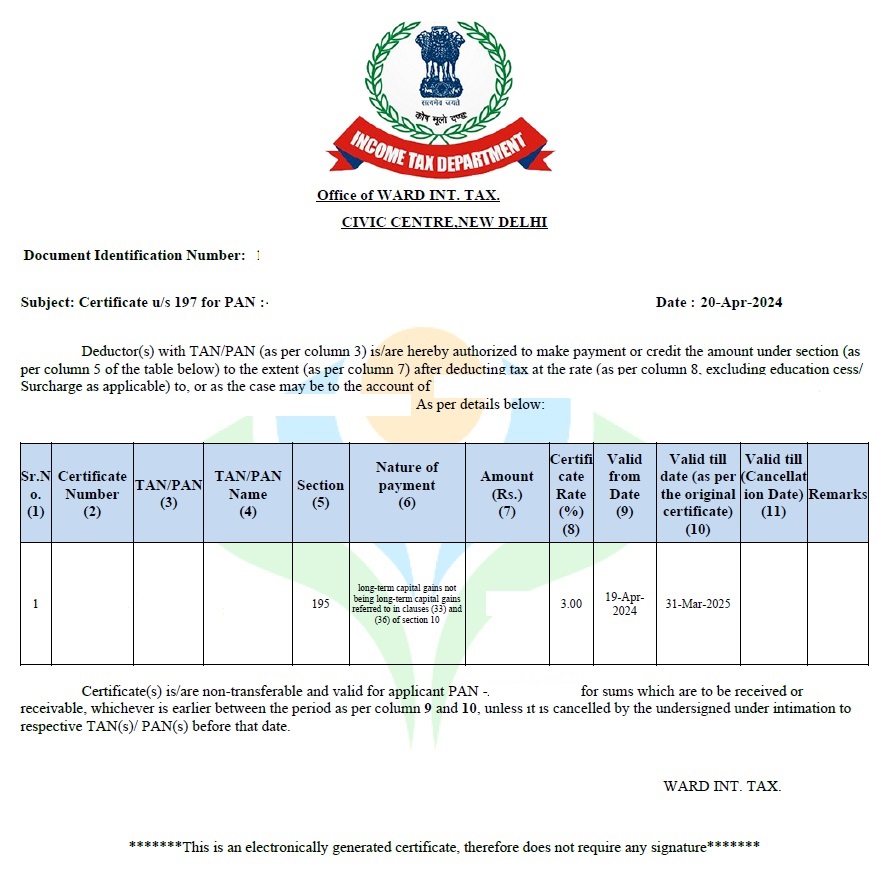

One significant oversight among NRIs is the lack of awareness regarding the option to apply for a lower TDS certificate. When selling property in India, NRIs can apply for a lower TDS certificate using Form 13 if the gain if lesser or if there’s a loss. Collaborating with a chartered accountant in India can expedite this process, especially when time is limited.

While NRIs may agree for a 20% TDS deduction plus surcharge and cess on sale transactions, however, applying for a lower TDS rate through Form 13 can significantly reduce this burden. In cases where there’s no gain or a loss on the property sale, NRIs can even apply for a zero income tax rate, although the department may impose a minimum 3% tax rate as per internal guidelines.

To ensure smooth property transactions in the future, it’s essential to consult with a chartered accountant in India. Our CA firm operates nationwide and can assist in obtaining lower TDS certificates within a short timeframe, making the process seamless for NRIs.

In summary, handling NRI laws and procedures related to property transactions in India requires careful consideration and expert guidance. By understanding the options available, including applying for lower TDS certificates, NRIs can optimize their financial dealings and ensure compliance with Indian tax regulations.

A Short Story of an NRI selling Property in India

Once upon a time, there was Ravi, a person living in the United States but originally from India. He had questions about Indian tax laws because he wanted to sell property in India. Ravi learned that someone like him, who spends more than half the year outside India, is called an NRI.

He found out that even though he lived in the US, he still had to follow some Indian tax rules, especially when it came to selling property back home. Ravi discovered that there were different taxes he might have to pay and different forms he needed to fill out.

He realized that the internet could tell him general information, but it didn’t explain everything. Ravi wanted to know about the practical difficulties he might face as an NRI selling property in India. He wondered about things like how much tax he’d have to pay, and if there was any way to pay less tax, especially if he was selling the property at a loss.

Ravi discovered with the help of chartered accountant that there was an option to apply for a special certificate that could help lower the amount of tax he had to pay. It was called a “lower TDS certificate” and he could apply for it using a form called Form 13. Opting the expertise of a chartered accountant, Ravi successfully obtained the certificate within a few days.

By filing Form 15CA and 15CB, Ravi repatriated most of his funds back to the US, with only a fraction deducted as TDS. The experience of chartered accountant showed him how important it is to understand NRI tax laws and use the available options wisely.

Here is the Format of Lower TDS certificate generated for NRI