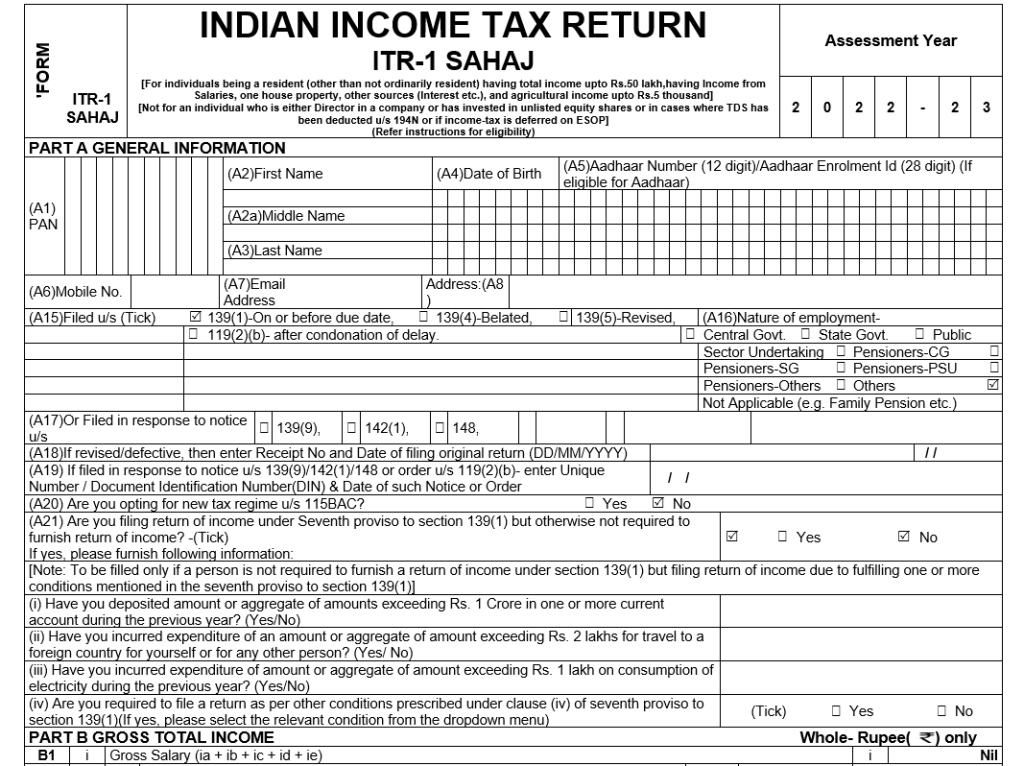

Income tax return (ITR) for the financial year 2021-22 i.e assessment year 2022-23 are open. Income tax department has issued offline utility of filing ITRs. ITR1 is one of the form uses for filing information of income by the salaried/employees.

Form ITR 1 is a simple form which you can fill it by yourself, provided you are aware of income tax provisions and aware about the ITR Form’s field. A single mistake or omission can make your return invalid or defective. Hence it become important for the taxpayer to file correct return by accumulating their source of income.

Every year Income tax department is made available information about taxpayer’s income and tax deduction at source (TDS) that reflect in Form 26AS. Recently Income tax department has issue comprehensive statement Taxpayer Information Summary (TIS) or the Annual Information Statement (AIS) that contains information about taxpayer’s receipt, income and TDS from various sources. Form 26AS, AIS and TIS help you in getting information in filling ITR since it contains the income details like Interest from Fixed deposit, Interest from saving bank, Dividend Income, Etc.

As the topic suggests, we will restrict our discussion to Form ITR 1 only. So let us understand the applicability of Form ITR 1 and what measure can be taken in advance to prevent income tax demand and faster processing of income tax refund.

Form ITR 1 (Sahaj) :

Who can file Form ITR 1: A resident and ordinarily resident individual can file Form ITR 1. That means a person other than individual cannot file ITR using form ITR 1 such as HUF, Companies, BOI, AOI, Cooperative society, etc.

Income can be covered in ITR 1: The following type of income can be filed in ITR 1:

- Income from salary

- Income from family pension

- Income from one house property (not being brought forward loss or losses to be carried forward)

- Income from other source (not being loss and winning from lottery /income from race horses) and who has not claimed deduction under section 57.

2. When ITR 1 is not applicable: Form ITR 1 is not applicable in the following cases when:

- Person is a director in any company;

- Person has assets located outside India or holding foreign assets such as stocks;

- Person held unlisted equity share at any time during the previous year;

- Person has agriculture income exceeding Rs. 5,000;

- Person has claimed relied under section 90/90A/91

- Person has total income exceeding Rs.50 lakh;

- Person have Short term or log term capital gain income

- Have income from business

Consequences if ITR is filed after the due date:

- The amount of late fee of Rs. 5,000 shall be payable under section 234F, where the ITR is filed after the due dates.

- In case of total income does not exceed Rs. 5 lakh, the fee amount shall not exceed Rs. 1,000.

- Section 271F of the income tax act penalises a person who required to file income tax return but fail to furnish.

Precaution can be taken:

- Disclose all your income even it is small in amount such as interest from saving banks.

- After filing ITR 1 make sure to e-verify through Aadhar OTP, EVC generated through net banking.

You may contact us at mail@nbaoffice.com for any information or query relating to income tax provisions. We are a term of Income tax consultants help you with a variety of tax-related issues.